What are NFTs?

Non-Fungible Tokens (NFTs) are unique digital assets verified using blockchain technology, the same technology behind cryptocurrencies like Bitcoin. Unlike cryptocurrencies, however, each NFT has its own distinct value and cannot be exchanged on a one-to-one basis with any other token, making them “non-fungible.”

This uniqueness is what makes NFTs particularly appealing for digital art, collectibles, and other online media, as it provides a way to prove ownership and authenticity in the digital realm.

These digital tokens can represent anything from artwork, music, videos, virtual real estate, and even tweets. When you buy an NFT, you’re essentially buying a digital certificate of ownership secured by blockchain, which can be traded or sold.

However, it’s important to note that owning an NFT does not mean you own the copyright to the digital asset, allowing the creator to retain their intellectual property rights. The rise of NFTs has transformed the digital art world, creating new opportunities for artists and collectors but has also brought its share of challenges and criticisms, particularly regarding environmental concerns, market volatility, and legal complexities.

How do NFTs Work?

Non-fungible tokens (NFTs) represent ownership or proof of authenticity of a unique item or piece of content, usually digital in nature, through blockchain technology. Here’s a more detailed breakdown of how they work:

1. Blockchain Technology:

NFTs exist on a blockchain, which is a decentralized and distributed digital ledger used to record transactions across many computers. Changes to the record can only occur if there is consensus across all participants in the system, making it very secure against fraudulent activities.

2. Token Standards (e.g., ERC-721):

Most NFTs are built using a specific set of standards that define how they should operate on a blockchain. The most common standard for NFTs on the Ethereum blockchain is ERC-721. This standard ensures that each token has unique properties and is not interchangeable on a one-to-one basis with any other token.

3. Minting:

Creating an NFT is known as “minting,” and it involves turning a digital file into a crypto collectible or digital asset on the blockchain. During the minting process, information such as the creator’s details, ownership history, and any other relevant metadata is embedded into the token.

4. Smart Contracts:

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically execute actions when predetermined conditions are met. In the context of NFTs, smart contracts might be used to handle transfers of ownership, ensure royalties are paid to the original creator upon resale, or even to programmatically alter the state of the NFT itself over time.

5. Ownership and Provenance:

When you buy an NFT, you gain ownership of a unique token on the blockchain, but not necessarily the copyright to the associated digital item. Ownership is recorded on the blockchain, and it can be transferred to others by selling or trading the NFT. The blockchain also transparently records the provenance of the NFT, showing its entire ownership history.

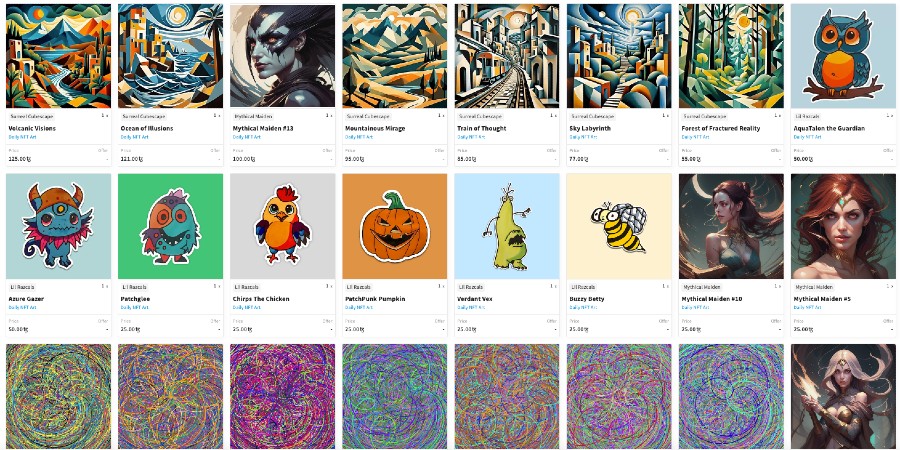

6. Marketplaces:

NFTs are bought, sold, and traded on various online marketplaces. To participate, users need a digital wallet to store their NFTs and cryptocurrency to make purchases. Transactions on these platforms are recorded on the blockchain, ensuring security and transparency.

Click Here for a list of popular NFT Marketplaces

7. Interoperability:

Some NFTs can be used across different applications and platforms, thanks to the interoperability of blockchain networks. For example, a virtual costume represented as an NFT in one game might be used in another game.

8. Rarity and Scarcity:

The value of NFTs is often driven by their rarity and scarcity. Creators can release limited editions or one-of-a-kind digital assets, and the blockchain ensures that the scarcity of the asset is verifiable.

9. Gas Fees:

Transactions on the blockchain, including creating and trading NFTs, require computational power, which incurs a cost known as a “gas fee.” Gas fees vary depending on network congestion and transaction complexity.

10. Environmental Impact:

The environmental impact of NFTs, particularly those on energy-intensive blockchains like Ethereum, has been a topic of discussion and concern. The computational power required for transactions and minting contributes to significant energy consumption.

The Popularity of NFTs

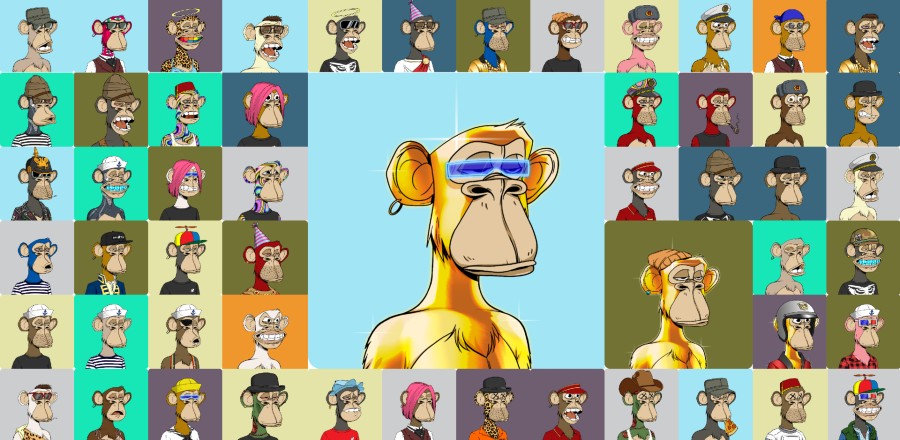

Non-fungible tokens (NFTs) have taken the digital world by storm, creating new opportunities for artists, gamers, collectors, and investors. Below, we delve deeper into the factors contributing to their widespread appeal.

Popular NFT collection Bored Ape Yacht Club sold for $24.4 million at a Sotheby’s auction in 2021.

1. Digital Ownership and Scarcity

- Verifiable Ownership: NFTs provide a blockchain-backed proof of ownership for digital assets. This has been particularly transformative for digital art and collectibles, where provenance and authenticity are crucial.

- Scarcity and Exclusivity: Artists can release limited editions of their work as NFTs, creating scarcity and driving demand. Collectors value the exclusivity of owning a rare digital asset.

2. Authentication and Provenance

- Indelible History: The blockchain records every transaction and transfer of ownership of an NFT, providing a transparent and unchangeable history. This provenance adds value to the digital asset.

- Combating Counterfeits: The art world, in particular, has battled issues of forgery for centuries. NFTs offer a solution by providing a way to verify the authenticity of a piece of art or collectible.

3. Accessibility and Democratization

- Global Market: NFTs have opened up a worldwide market for artists and creators. Anyone with an internet connection can create, buy, or sell NFTs, breaking down geographical and economic barriers.

- Direct Artist-to-Collector Transactions: Artists can sell their work directly to collectors without the need for intermediaries like galleries or auction houses, resulting in potentially higher profits and greater control over their work.

4. Innovations in Art and Media

- New Artistic Mediums: NFTs have given rise to entirely new forms of digital art, interactive pieces, and multimedia experiences. Artists are exploring the unique possibilities offered by blockchain and smart contracts.

- Digital Fashion and Virtual Goods: Beyond art, NFTs are being used to trade virtual clothing, accessories, and other digital goods, influencing industries like fashion and gaming.

5. Speculation and Investment

- High-Profile Sales: News of NFTs selling for millions of dollars has captured public attention, attracting both collectors and speculators looking to profit from the market.

- Diversification of Investment Portfolios: Some investors view NFTs as a way to diversify their portfolios, investing in digital art and collectibles in the same way one might invest in physical art or real estate.

6. Community and Social Aspects

- Fostering Communities: Many NFT projects and platforms have built strong communities of artists, collectors, and enthusiasts who share a passion for digital art and collectibles.

- Social Status and Bragging Rights: Owning a rare or highly sought-after NFT can provide a sense of prestige and social status within these communities.

7. Innovation in Technology and Finance

- Smart Contracts: The use of smart contracts in NFTs has introduced innovative ways of managing royalties, ownership rights, and other aspects of digital assets.

- Decentralized Finance (DeFi) Integration: NFTs are becoming integrated with decentralized finance, offering new ways to use digital assets for lending, borrowing, and earning interest.

8. Media and Celebrity Endorsement

- High-Profile Endorsements: Celebrities, musicians, and influencers have embraced NFTs, bringing them into the mainstream and attracting their followers to the space.

- Media Coverage: The extensive media coverage of NFTs has played a significant role in their popularity, highlighting both the positive aspects and the controversies surrounding them.

Challenges and Criticisms

The overlap between NFTs and copyright can lead to legal issues like infringement when unauthorized parties deal in NFTs tied to works without owner consent.

1. Environmental Concerns

- Energy Consumption: The proof-of-work blockchain networks that many NFTs are built on, such as Ethereum, require immense computational power for transaction validation and mining, leading to significant energy consumption.

- Carbon Footprint: The energy required for these operations largely comes from non-renewable sources, contributing to carbon emissions and environmental degradation.

- Efforts for Sustainability: In response, there are initiatives and upgrades in progress, such as Ethereum 2.0, aiming to reduce the environmental impact by shifting to a more energy-efficient proof-of-stake consensus mechanism.

2. Market Volatility

- Price Fluctuations: The NFT market is known for its rapid price fluctuations, with the value of NFTs capable of soaring or plummeting in a short period. This volatility can be daunting for investors and creators alike.

- Speculative Nature: Many purchases in the NFT space are driven by speculation, with buyers hoping to resell assets at a higher price, adding to the market’s instability.

3. Intellectual Property and Legal Issues

- Copyright Confusion: Owning an NFT does not necessarily mean owning the copyright to the digital asset it represents. This has led to confusion and potential legal challenges.

- Plagiarism and Unauthorized Minting: There have been instances of artists’ works being minted and sold as NFTs without their permission, raising concerns about plagiarism and the need for better copyright protection in the space.

4. Lack of Regulation

- Potential for Fraud: The decentralized and relatively unregulated nature of the NFT market can make it a breeding ground for scams and fraudulent activities.

- Need for Consumer Protection: There are calls for clearer regulations and guidelines to protect consumers and ensure fair practices in the market.

5. Accessibility and Inclusivity

- Digital Divide: While NFTs offer global accessibility, there is still a digital divide, with individuals in certain regions or socioeconomic statuses lacking the resources to participate.

- Diversity Concerns: Ensuring diversity and inclusivity in the NFT space, particularly for artists and creators, remains a challenge.

6. Ethical Considerations

- Cultural Appropriation: There have been instances of cultural appropriation in the NFT space, with artists profiting off cultures that they are not a part of.

- Exploitative Practices: As the NFT market continues to grow, there is a need to be vigilant against exploitative practices and ensure fair compensation for creators.

7. Long-Term Viability

- Bubble Concerns: Some critics argue that the NFT market is a bubble, drawing parallels to previous market bubbles in history.

- Sustainability of Interest: Questions also arise about the long-term interest and sustainability of NFTs, particularly if the market cools off or if new technologies emerge.

Conclusion

NFTs represent a revolutionary shift in how we think about ownership, authenticity, and value in the digital realm. While they offer numerous benefits and opportunities, they also pose challenges and raise important questions about sustainability, legal frameworks, and market dynamics. As the space continues to evolve, it will be crucial to address these issues to ensure a stable, equitable, and sustainable future for NFTs.